A sample bank statement PDF is a digital replica of a bank account’s transaction history‚ offering a secure‚ accessible‚ and eco-friendly way to track financial activities.

1.1 What is a Bank Statement PDF?

A Bank Statement PDF is a digital document summarizing a bank account’s transactions over a specific period‚ typically monthly. It includes details like account holder’s name‚ account number‚ statement period‚ deposits‚ withdrawals‚ and ending balance. This format is widely used for financial tracking‚ budgeting‚ and reconciliation‚ offering convenience and security for account holders to access their financial records electronically.

1.2 Importance of Bank Statements in Financial Management

Bank statements are crucial for tracking transactions‚ verifying account balances‚ and monitoring financial health. They aid in budgeting‚ identifying spending patterns‚ and reconciling accounts. Additionally‚ they serve as proof of income or funds‚ essential for loans‚ visas‚ or business transactions. Regular review of bank statements helps detect fraud and ensures financial transparency‚ making them indispensable for personal and business financial management.

Structure of a Sample Bank Statement

A sample bank statement PDF typically includes the account holder’s name‚ account number‚ statement period‚ list of transactions‚ and ending balance for clear financial tracking.

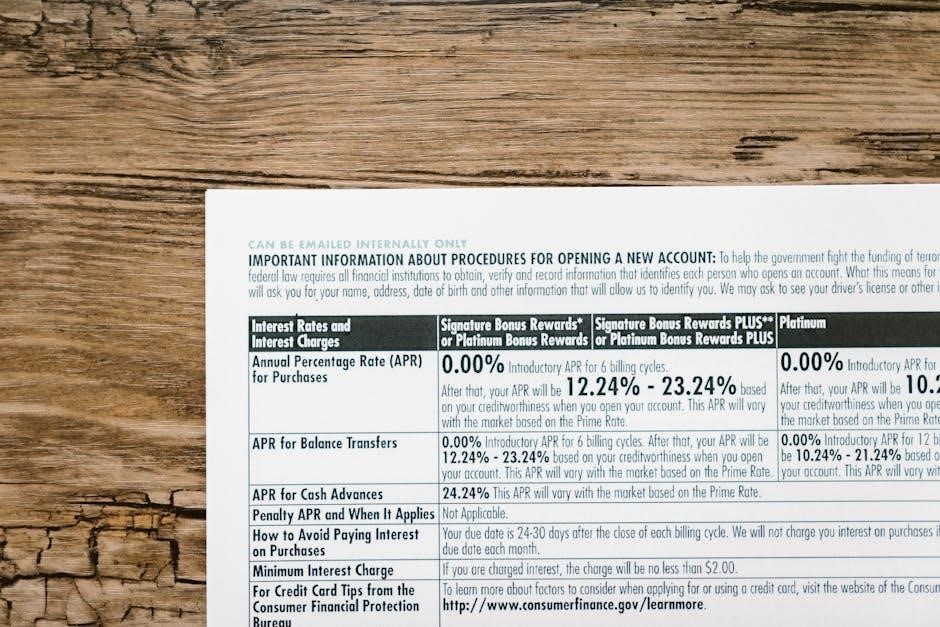

2.1 Key Features of a Bank Statement

A bank statement typically includes account details‚ transaction summaries‚ and balance information. Key features are the account holder’s name‚ account number‚ statement period‚ transaction dates‚ descriptions‚ and amounts. It also shows the beginning and ending balances‚ helping users track financial activities. Statements are available in formats like PDF‚ ensuring security and convenience. They often include bank logos‚ watermarks‚ and official details for authenticity. These features make bank statements essential for monitoring and organizing finances effectively.

2.2 Components of a Bank Statement

A bank statement includes essential details such as the account holder’s name‚ account number‚ and statement period. It lists transactions with dates‚ descriptions‚ and amounts‚ distinguishing between deposits and withdrawals. The beginning and ending balances are prominently displayed‚ along with the total debits and credits. Additional details like check numbers‚ transaction codes‚ and bank references may also be included. These components provide a clear and comprehensive overview of financial activities during the specified period.

Bank Statement Templates and Formats

Bank statement templates are available in PDF‚ Word‚ and Excel formats‚ offering editable and customizable options for users to manage financial data efficiently and professionally.

3.1 Overview of Bank Statement Templates

Bank statement templates provide structured layouts for displaying financial data‚ available in PDF‚ Word‚ and Excel formats. They include customizable fields for account details‚ transaction history‚ and balances. These templates are designed to mimic real bank statements‚ offering security features like watermarks and professional designs. Users can download editable versions from websites like mytempl.com and oxtempl.com‚ making them ideal for personal or business financial tracking and planning.

3.2 Popular Formats for Bank Statements (PDF‚ Word‚ Excel)

Bank statements are commonly available in PDF‚ Word‚ and Excel formats. PDFs are ideal for security and readability‚ while Word and Excel allow editing and customization. These formats cater to different needs‚ from professional presentations to data analysis. Templates in these formats can be downloaded from websites like mytempl.com and oxtempl.com‚ offering flexibility for personal or business use.

How to Generate and Customize a Bank Statement

Generate a bank statement using tools like PDFSimpli or specialized software. Customize templates by adding account details‚ transaction history‚ and formatting to suit specific needs or branding requirements.

4.1 Tools and Software for Creating Bank Statements

Various tools like Adobe Acrobat‚ PDFSimpli‚ and Receipt Bot enable easy creation and customization of bank statements. These platforms offer editable templates‚ allowing users to input account details‚ transaction history‚ and formatting. Specialized software can also automate data entry and ensure compliance with specific banking formats. Additionally‚ tools like Python scripts and online converters facilitate PDF editing and data extraction for further analysis or reporting purposes.

4.2 Tips for Customizing Bank Statement Templates

When customizing bank statement templates‚ ensure consistency in formatting and branding. Tailor the layout to specific needs‚ adding or removing sections as required. Use advanced formatting options in tools like Adobe Acrobat for professional designs. Always include placeholders for dynamic data like account numbers and dates. Organize transactions chronologically and categorize them for clarity. Utilize layering in PDFs for easy editing and ensure compatibility with multiple formats like PDF‚ Word‚ and Excel.

Downloading and Editing Bank Statements

Downloading bank statements in PDF format is straightforward via online banking. Use tools like Adobe Acrobat or Receipt Bot to edit and convert statements for specific financial needs securely.

5.1 How to Download Bank Statements in PDF Format

To download a bank statement in PDF format‚ log in to your online banking platform‚ navigate to the account section‚ and select the desired statement period. Click the download option‚ choose PDF format‚ and save the file securely. Ensure the statement includes account details‚ transaction history‚ and balances for accurate financial records. Tools like Adobe Acrobat or Receipt Bot can assist in editing or converting these PDFs for further use.

5.2 Editing Bank Statements for Specific Needs

Editing bank statements can be necessary for various reasons‚ such as updating account details or correcting transaction errors. Tools like Receipt Bot and the Bank Statement Converter Website enable users to convert PDF statements to editable formats like CSV or Excel. Once converted‚ users can modify the data as needed. After editing‚ it’s crucial to ensure the document’s security and authenticity‚ especially when used for official purposes. This helps maintain the integrity of financial records.

Converting Bank Statements to Other Formats

Bank statements can be converted to CSV‚ Excel‚ or other formats using tools like Receipt Bot or Adobe converters for easier data analysis and integration.

6.1 Converting PDF Bank Statements to CSV or Excel

Converting PDF bank statements to CSV or Excel enables efficient data analysis and integration into accounting systems. Tools like Receipt Bot or Adobe converters simplify this process‚ allowing users to upload PDFs and download them in CSV or Excel formats. Automated solutions parse transaction details‚ ensuring accuracy and saving time. This conversion is particularly useful for budgeting‚ financial planning‚ and reconciling accounts‚ making it a valuable step in managing personal or business finances effectively.

6.2 Tools for Bank Statement Conversion

Various tools facilitate the conversion of bank statements from PDF to other formats. Receipt Bot and Adobe converters are popular for PDF to CSV or Excel conversions. Additionally‚ custom scripts using Python can automate the process‚ parsing data from PDF files. These tools enhance efficiency‚ enabling seamless integration of financial data into accounting systems for analysis and reporting‚ making financial management more streamlined and accessible.

Analyzing Bank Statements for Financial Insights

Analyzing bank statements reveals spending habits‚ income trends‚ and financial health‚ enabling better budgeting‚ forecasting‚ and informed decision-making for personal or business financial planning and management.

7.1 Using Bank Statements for Budgeting and Planning

Bank statements provide detailed transaction records‚ enabling individuals and businesses to track income and expenses. By analyzing these records‚ one can identify spending habits‚ allocate resources efficiently‚ and set financial goals. This data is essential for creating realistic budgets and long-term financial plans‚ ensuring better money management and decision-making. Using tools to convert PDF statements to CSV or Excel formats simplifies analysis‚ making it easier to integrate into budgeting software for accurate planning and financial health monitoring.

7.2 Extracting Data from Bank Statements for Analysis

Extracting data from bank statements involves converting PDF files into formats like CSV or Excel for easier analysis. Tools like Receipt Bot and Adobe converters simplify this process‚ enabling users to access transaction details‚ balances‚ and trends. Automated software can categorize expenses‚ identify patterns‚ and generate financial reports. This data is crucial for accounting‚ tax preparation‚ and financial forecasting‚ helping businesses and individuals make informed decisions and optimize their financial management strategies.

Uses of Sample Bank Statements

Sample bank statements are essential for financial tracking‚ proof of funds‚ and business accounting. They provide a clear record of transactions‚ aiding in budgeting‚ planning‚ and verification processes.

8.1 Bank Statements for Business Accounting

Bank statements are essential for business accounting‚ enabling companies to track income‚ expenses‚ and cash flow. They provide a detailed record of transactions‚ helping businesses prepare financial reports‚ monitor budgets‚ and comply with audits. By analyzing bank statements‚ businesses can identify financial trends‚ manage funds effectively‚ and make informed decisions. Available in formats like PDF‚ Word‚ or Excel‚ they offer flexibility for customization and analysis‚ ensuring accurate financial record-keeping.

8.2 Bank Statements as Proof of Funds

Bank statements serve as essential proof of funds‚ demonstrating an individual’s or business’s financial standing. They are widely accepted for loan applications‚ lease agreements‚ and visa processes‚ providing a credible record of income and expenses. PDF bank statements are particularly favored for their security and authenticity. Accessible through online banking‚ they offer a convenient way to verify financial stability‚ making them indispensable for various legal and financial requirements globally.

A sample bank statement PDF is an invaluable tool for managing and understanding financial transactions. It provides a clear‚ organized record of account activity‚ aiding in budgeting‚ planning‚ and compliance. Whether for personal or business use‚ its versatility in formats like PDF‚ Word‚ and Excel makes it universally accessible. By leveraging customizable templates and conversion tools‚ users can efficiently analyze and utilize bank statements to meet their financial goals and requirements.

Leave a Reply

You must be logged in to post a comment.